obviously, the insurance declare approach is never this clean. Most claims experience various problems alongside the way in which. These troubles could jeopardize your assert and lessen get more info payout – Which is the reason you may want a general public adjuster.

But independent agents usually are not held captive by 1 organization. They're free of charge to tailor options to suit you, your preferences, your life, that may help you make the possibilities which are best for your needs. for those who at any time need to file a declare, your unbiased agent may help you by way of the procedure. And as everyday living modifications, you can also count on your independent agent that will help you update your alternatives. Those are merely a few of the explanations selecting an impartial insurance agent is this kind of a sensible choice. See the primary difference for yourself.

Insurance enterprise adjusters might be helpful. having said that, you and your insurance enterprise might need different objectives:

Due to this fact, you may expect your insurer to expedite the resolution of your declare. The more time it's open up, the more most likely it's that you're going to find a subsequent reduction and file a claim.

The insurance corporation’s adjuster is really a salaried worker or contractor who operates for your insurance organization. The adjuster’s aim can be to reduce fire insurance claim settlement – not give you with as much dollars as you like.

A community adjuster is really an insurance business Qualified who is effective for policyholders – not insurance businesses. Public adjusters want that can help improve declare settlements and overturn declare denials to assist policyholders get the reasonable compensation they are entitled to.

due to the fact these adjustors get the job done for your insurance business, It is really inside their ideal pursuits to get you to quickly settle for a modest settlement. You're under no obligation to simply accept these numbers.

overview Your coverage & Coverages: a lot of homeowners don’t comprehend their homeowners insurance coverage right up until it’s way too late. Verify your limits. you should definitely understand the distinction between substitute Expense and actual funds worth coverage.

House fires, industrial fire hurt, and fire harmed assets are all devastating. Dealing with your insurance business as well as the insurance adjuster from the fire insurance declare process, during these hard time, is usually too much to handle for policyholders.

await the adjuster. Your insurance corporation sends an adjuster on your address to inspect the scene, estimate the hurt, restoration and fix prices, and figure out another action.

In relation to lodging prices, you can expect to Just about likely be capable to get reimbursed for the entire quantity. Your property finance loan, taxes, and insurance payments are still due Even though you are no longer dwelling in your own home. having to pay insurance rates is covered in more depth in Tip Seven under.

The Insurance info Institute is often a information and knowledge internet site with many distinct advice for individuals, which includes ways to file a declare.

Whether your house experienced slight problems or destruction, you ought to Get hold of your insurance company as soon as possible to file a homeowners insurance declare. Your insurer will assign an adjuster to critique the damage, ascertain protection, and perform with you to arrange repairs.

bear in mind: insurance can be a for-profit business enterprise and never a charity. An insurance corporation’s objective is to pay as very little as lawfully feasible to get a fire insurance claim. Insurers normally seek out any justification to lessen fire injury estimates and assert settlement payments.

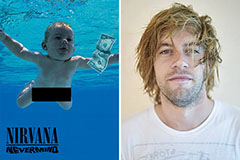

Spencer Elden Then & Now!

Spencer Elden Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!